Are You Worried About Not Having Enough Money ?

To Live On in Retirement Knowing That Superannuation Alone = Retirement Disaster?

Most Aussies Don’t Realise the Massive Retirement Shortfall Until It’s Too Late.

Learn The Proven Property Investing System That Guarantees Your Financial Security And Gives You The Freedom To Live Life Entirely On Your Terms!

Get a Clear, Stress-Free Plan to Your Next Property Investment

"Buy The Right Property, In The Right Location, At The Right Price — Build Wealth With Confidence"

Learn how to structure your finances, optimise cashflow and grow wealth you can rely on — without making any costly mistakes.

83% of Australians Will Be $500,000 Short in Retirement And Their Sitting Ducks for Financial Stress

If You Only Have Super One Stock-Market Crash Could Wipe Out Your Retirement Dreams!

Adding One or Two Investment Properties To Your Assets Builds You More Financial Security

If you do nothing, your financial future won’t just feel tight — it will slowly tighten around you. More stress. More sacrifice. More “we’ll just have to make do.” More nights wondering if this is as good as it gets.

When your working life ends YOU DESERVE better than that.

Smart Property.

Real Returns.

No Spruiker Fees.

We help everyday

Aussies build wealth

through smart property investing — and you walk away with $10k plus in built-in value on your first deal.

We help everyday Aussies build wealth through smart property investing — and you walk away with $10k plus in built-in value on your first deal.

The Financial Reality You Can’t Afford to Ignore

You’ve worked hard. You’ve paid taxes. You’ve chipped away at your mortgage. You've been doing the best you can with what you know and unfortunately the odds of success have been stacked against you.

Look it's not your fault, it's the money system we have been conditioned to be in!

HERE'S THE TRUTH IF YOU'RE RELYING ON SUPER ALONE

Holidays Will Become

“Maybe Next Year”

Helping Your Kids Financially

Will Be Impossible.

Every Grocery Shop & Power Bill

Will Feel Like A Decision About What You Can or Can't Have.

THIS ISN’T JUST ABOUT MONEY.

IT’S ABOUT DIGNITY, FREEDOM AND CHOICE AND THE CLOCK IS TICKING.

After Years of Hard Work..

This is the REWARD You Deserve

Picture this instead:

Waking Up On A Monday

And Knowing You Never Have To Answer To A Boss Again.

Taking 2–3 Holidays A Year

Without Worrying About The Cost.

Mortgage Is Paid Off

Your Investments Are Growing and your accounts is always in the green

Giving Your Family

The Life You Promised Yourself You’d Give Them.

That’s financial security. That’s job freedom.

And it’s achievable faster than you think with the right plan.

That’s financial security. That’s job freedom.

Being involved in property since 2003 I know first hand how it feels!

WHY MOST PEOPLE STAY STUCK

If you’re thinking about buying your first investment property, you’ve probably said:

“I can’t afford an investment property on top of my home loan."

“I’m already in debt, more debt seems crazy.”

“What if I lose money every week?”

If you already own an investment property, maybe you’ve thought:

“This property is bleeding me dry.”

“I see money going out every week, Is this property making or costing me money?”

Truth: It’s not the property that’s the problem, it’s the missing money management system.

The problem is no-one has ever shown you how the cashflow works or how to structure your loans and turn your property into a reliable wealth engine instead of a source of stress.

WHY PROPERTY SPRUIKERS AND DIY CAN COST YOU YEARS

Right now, property spruikers are charging $15K–$25K to throw you into a property

and walk away leaving you all alone.

No strategy, No cashflow coaching, No structure,

No ongoing support.

The result? You’re left with a property you don’t understand.

Cashflow that bleeds you dry and stress that makes you want to sell (maybe at a loss).

Your Turning Point:

Use A Proven Property System That Works

Finding the right property is only 30% of success.

The other 70% is managing the cash flow after you buy

I Show You How Rent, Tax Benefits & Depreciation Work

Together To Build Wealth

I Show You How To Structure Your Banking

So Money Flows To The Right Places Automatically

I Show You Structures and How To Remove Stress

So You Can Confidently Buy Your Next Property

When you have this system, everything changes

Fear Is Replaced

With Certainty

Becomes Clarity

Confusion

Becomes Clarity

Becomes Clarity

“What If” Turns Into

“When We Do This Next”

Real Client Story: Mark & Skye

BEFORE

Unsure if they could afford it

Stressed about their mortgage

Confused about where their money went

AFTER

Saved $110K in 14 months to buy their first home

Bought their first investment property

👉 Increased cashflow by $1,100/week — saved 11 years and $100K in interest.

Mark’s words:

"This has taken all the money stress right out of it for us.

We can see our house paid off and our investments growing.

We’re absolutely stoked."

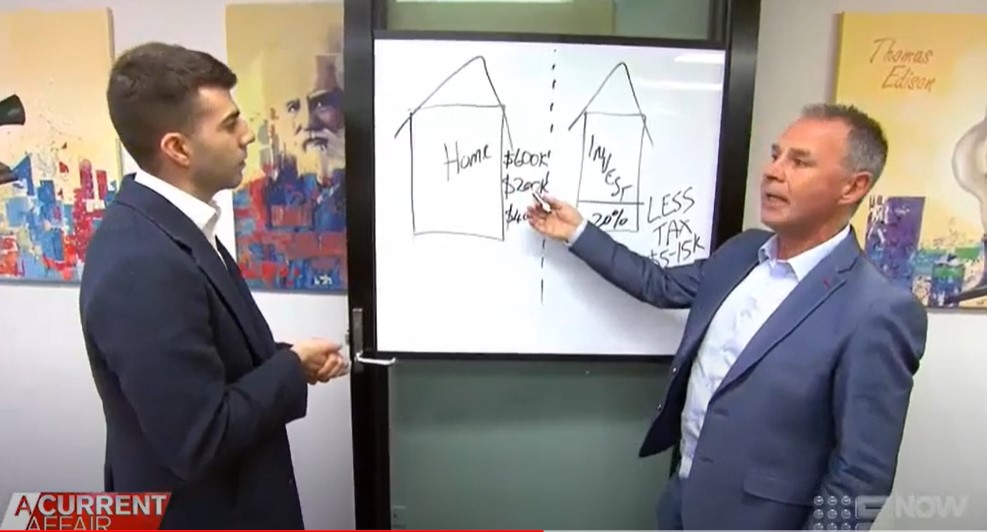

Tony was featured on A Currnet Affair

About Me

I’m Tony Harrington, Accredited Property Investment Advisor with 25+ years of investing experience and a multi-million-dollar personal portfolio.

I’ve helped hundreds of first-time and experienced investors build portfolios worth hundreds of thousands often adding $200K–$400K in value within 3–5 years.

Unlike property spruikers, I don’t just find you a property and disappear. I teach you the cashflow system, fix your structures and stay with you until you’re financially secure.

How We Work Together

STEP 1

Foundation & Reality Check

We run the numbers so you know exactly what you can afford and when you’ll be financially free.

STEP 2

Structure & Setup

We fix your banking and loan structure, so your money works for you, not the bank.

STEP 3

Confidence & Clarity

You’ll know exactly where your money is going, when your mortgage will be gone and how your investments are growing.

STEP 4

Ongoing Support

You’re never left alone, I stay with you until you’ve hit your goals.

Here’s What You Get To Make Your Financial Dreams A Reality

For First-Time Investors

For Existing Investors

Clear plan to afford your first property

Property sourcing with full research and demographic data

Banking structure and loan optimisation setup

Step-by-step cashflow coaching from day one

Ongoing support and community access

Full review of your current investments

Identify and repair cashflow leaks

Restructure your banking for efficiency and growth

Clear strategy for your next purchase

Ongoing guidance to scale confidently

The Risk-Free Invitation

Get your free Property Wealth Plan + discover how you could save or add $10,000+ on your first deal.

I’ll Keep Working With You At No Extra Cost Until I Do.

The Cost of Waiting

Every month you delay

❌Your Future Wealth Shrinks

❌ The Years You Could Retire Early Disappear

❌ You Hand More Money To The Bank Instead Of Keeping It In Your Pocket

Doing nothing is the most expensive choice you can make.

This isn’t about buying a property.

It’s about planning and buying your freedom.

No pressure. Just clarity, a plan and the first step toward the life you’ve been working for.